7 Essential Rich Finance Tips for Maximizing Your Wealth

Are you an entrepreneur or business-savvy individual looking to maximize your wealth and elevate your financial game? You've come to the right place! In this blog post,we'll reveal 7 Fundamental Wealthy Fund Tips that can hoist your money related well-being. Don't miss out on these money-making secrets; dive in and discover how to unlock your full financial potential!

Importance of Financial Planning

Building Riches Step by Step

Embarking on the street to money related victory starts with fastidious arranging. Learn how taking little, steady steps can lead to critical riches aggregation over time.It's not approximately the goal; it's almost the journey.

Budgeting for Success

Creating a Reasonable Budget

Budgeting is the foundation of money related soundness. Find the craftsmanship of creating a reasonable budget that adjusts along with your budgetary objectives. Reveal the privileged insights of designating stores admirably to maximize your reserve funds potential.

Investment Strategies

Diversifying Your Portfolio

Explore the world of venture and get it the importance of broadening.Learn how spreading your speculations over different resources can moderate dangers and upgrade long-term returns.

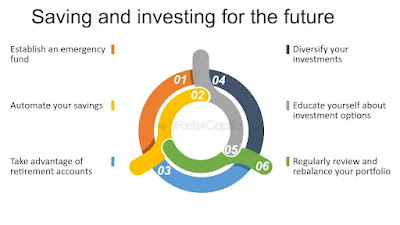

Smart Saving Techniques

Maximizing Your Reserve funds Potential

Discover viable and successful sparing procedures that go past conventional strategies. From mechanizing reserve funds to leveraging innovation, discover out how to form your cash work for you.

Debunking Financial Myths

Common Misconceptions

Separate reality from fiction as we expose predominant monetary myths. Understanding these misinterpretations is pivotal for making educated choices and dodging pitfalls on your wealth-building travel.

Achieving Financial Goals

Setting and Achieving Milestones

Setting clear and achievable budgetary objectives is key to victory. Learn the craftsmanship of goal-setting and find techniques to overcome challenges on your way to budgetary fulfillment.

7 Essential Rich Finance Tips for Maximizing Your Wealth

Tip 1: Setting Clear Goals

Define your budgetary destinations with clarity. Get it how having a clear vision shapes your monetary choices and moves you towards success.

Tip 2: Building a Differing Investment Portfolio

Explore the benefits of a differentiated speculation procedure.From stocks to genuine bequest, learn how to make a portfolio that stands flexible against showcase fluctuations.

Tip 3: Smart Budgeting and Expense Tracking

Master the craftsmanship of budgeting and track your costs scholarly people. Find commonsense tips to streamline your accounts and optimize your investing habits.

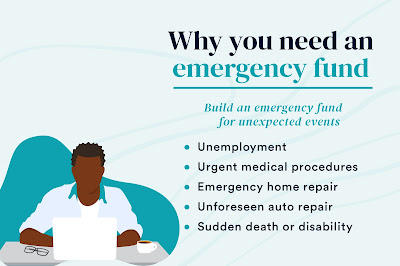

Tip 4: Emergency Finance Essentials

Understand the significance of an crisis finance and how it acts as a budgetary security net. Learn how to construct and keep up an crisis support for startling costs.

Tip 5: Regularly Investigating Your Finances

Continuous budgetary evaluation is vital. Learn why routinely looking into your money related standing is fundamental for adjusting to changes and remaining on the way to riches maximization.

Tip 6: Looking for Professional Financial Advice

Explore the benefits of looking for master exhortation. Get it how budgetary experts can give personalized direction custom fitted to your special budgetary situation.

Tip 7: Continual Learning and Adaptation

The monetary scene advances; remain ahead by cultivating a attitude of nonstop learning.Find assets and methodologies to remain educated and adjust to changes within the budgetary world.

FAQs

- Are these tips applicable to everyone?

Absolutely! The standards laid out are all around appropriate, in any case of your current budgetary situation.

- How much should I invest initially?

The beginning venture sum shifts; it's significant to begin with an sum that adjusts along with your money related capabilities and objectives.

- Can I depend exclusively on budgeting?

While budgeting is basic, combining it with vital speculations improves your wealth-building potential.

- Is professional financial advice necessary?

While not required, proficient exhortation can give important bits of knowledge and personalized techniques for your money related journey.

- How regularly should I review my funds?

Regular monetary audits are prescribed, in a perfect world each quarter, to guarantee you remain on track and adjust to changing circumstances.

- What assets can offer assistance in monetary education?

Online courses, trustworthy money related websites, and books by back specialists are fabulous assets for improving your budgetary knowledge.

Read Also:Click Here

Conclusion

In conclusion, acing the 7 Essential Wealthy Finance Tips is your portal to money related victory. By setting clear objectives, broadening speculations, budgeting shrewdly, and remaining educated, you clear the way for a affluent future.Keep in mind, budgetary victory could be a travel, not a goal.

Post a Comment